More About Pvm Accounting

Table of ContentsThe Best Strategy To Use For Pvm AccountingA Biased View of Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.6 Easy Facts About Pvm Accounting ShownThe smart Trick of Pvm Accounting That Nobody is DiscussingSome Known Details About Pvm Accounting

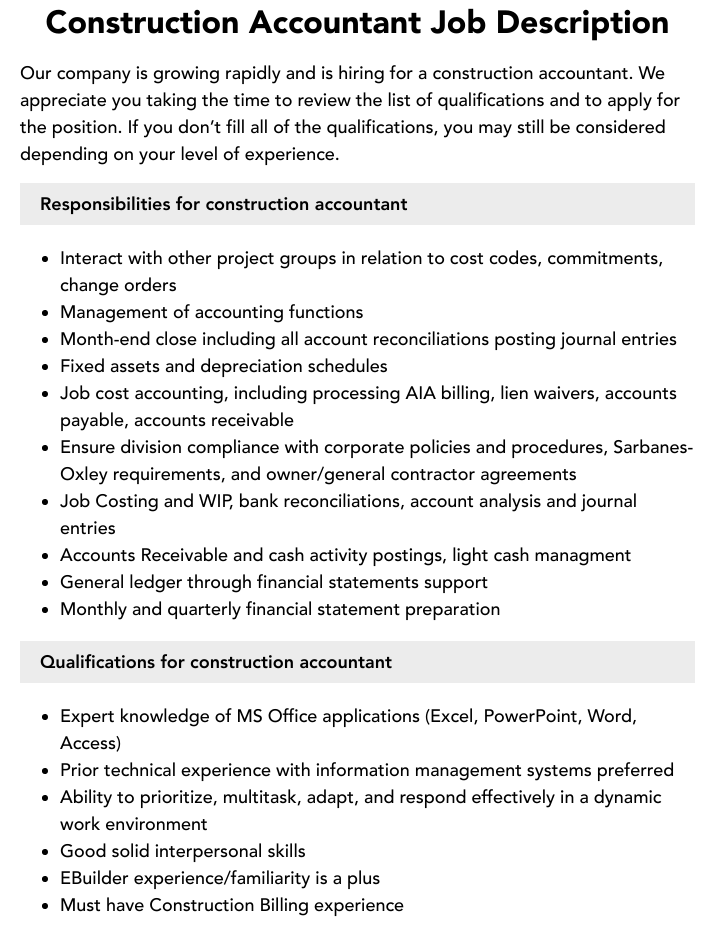

Supervise and deal with the development and approval of all project-related payments to clients to cultivate excellent interaction and stay clear of issues. Clean-up accounting. Make certain that appropriate records and paperwork are submitted to and are updated with the internal revenue service. Make certain that the audit process adheres to the regulation. Apply needed building bookkeeping standards and treatments to the recording and reporting of building and construction activity.Understand and maintain typical expense codes in the bookkeeping system. Communicate with numerous funding firms (i.e. Title Company, Escrow Firm) pertaining to the pay application procedure and demands required for settlement. Manage lien waiver dispensation and collection - https://worldcosplay.net/member/1768246. Screen and deal with financial institution concerns including fee anomalies and check differences. Assist with carrying out and keeping interior economic controls and treatments.

The above statements are planned to explain the basic nature and degree of job being carried out by people assigned to this category. They are not to be understood as an extensive listing of responsibilities, obligations, and abilities needed. Employees may be called for to do tasks outside of their normal duties every now and then, as needed.

Examine This Report about Pvm Accounting

You will help sustain the Accel group to ensure shipment of effective on schedule, on budget, projects. Accel is looking for a Construction Accounting professional for the Chicago Office. The Construction Accountant performs a range of audit, insurance coverage compliance, and project administration. Functions both individually and within certain divisions to preserve economic records and make certain that all records are maintained present.

Principal tasks include, but are not limited to, handling all accounting features of the business in a timely and exact manner and providing reports and timetables to the business's certified public accountant Firm in the prep work of all monetary declarations. Makes sure that all accounting treatments and features are managed properly. Responsible for all monetary records, pay-roll, financial and everyday procedure of the audit feature.

Functions with Task Supervisors to prepare and publish all regular monthly billings. Generates month-to-month Task Cost to Date records and functioning with PMs to resolve with Task Managers' budget plans for each task.

Pvm Accounting - Truths

Effectiveness in Sage 300 Construction and Real Estate (formerly Sage Timberline Office) and Procore building and construction management software an and also. https://www.wattpad.com/user/pvmaccount1ng. Must also be competent in various other computer system software application systems for the prep work of records, spreadsheets and various other accountancy analysis that might be needed by management. construction taxes. Must have solid organizational skills and ability to focus on

They are the financial custodians who ensure that building tasks remain on spending plan, follow tax obligation regulations, and preserve monetary openness. Building and construction accountants are not just number crunchers; they are critical companions in the construction process. Their key duty is to manage the monetary elements of building and construction projects, ensuring that sources are allocated successfully and monetary threats are minimized.

The Pvm Accounting Statements

They work closely with project managers to develop and monitor budgets, track expenses, and projection economic demands. By keeping a tight grip on project financial resources, accountants help prevent overspending and financial setbacks. Budgeting is a keystone of effective building and construction jobs, and construction accountants are instrumental in this respect. They produce comprehensive budget plans that encompass all job costs, from materials and labor to authorizations and insurance policy.

Navigating the facility web of tax regulations in the building and construction industry can be challenging. Construction accountants are skilled in these regulations and make certain that the job follows all tax obligation needs. This consists of handling payroll taxes, sales taxes, and any various other tax obligation commitments details to construction. To master the duty of a building accounting professional, people require a solid educational structure in accountancy and finance.

Additionally, certifications such as State-licensed accountant (CPA) or Certified Building And Construction Sector Financial Specialist (CCIFP) are highly concerned in the industry. Working as an accounting professional in the construction market features a distinct collection of obstacles. Construction jobs often include limited target dates, changing policies, and unanticipated expenses. Accountants need to adapt promptly to these obstacles to maintain the task's economic wellness undamaged.

Pvm Accounting - The Facts

Specialist qualifications like certified public accountant or CCIFP are likewise highly recommended to show knowledge in building accountancy. Ans: Building accountants develop and check spending plans, determining cost-saving chances and making certain that the task remains within spending plan. They also track costs and forecast economic requirements to avoid overspending. Ans: Yes, building and construction accountants take care of tax conformity for construction jobs.

Intro to Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies click here for more have to make challenging options among lots of economic choices, like bidding process on one task over an additional, picking funding for products or tools, or setting a job's profit margin. Building and construction is an infamously unstable market with a high failure rate, slow-moving time to settlement, and inconsistent cash circulation.

Manufacturing entails duplicated processes with easily recognizable expenses. Production calls for various processes, products, and tools with differing prices. Each task takes location in a new place with varying website problems and one-of-a-kind obstacles.

Getting My Pvm Accounting To Work

Regular use of different specialty service providers and providers impacts efficiency and cash circulation. Settlement shows up in full or with regular payments for the full agreement quantity. Some part of payment may be withheld until job completion even when the service provider's job is ended up.

While standard producers have the benefit of controlled atmospheres and optimized manufacturing procedures, building and construction business need to continuously adjust to each new task. Even rather repeatable jobs call for adjustments due to website conditions and various other factors.

Comments on “Rumored Buzz on Pvm Accounting”